Pricing For Rare Disease Therapies And Cures: What's Fair?

By Andrew Parece and Matthew Majewski, Charles River Associates

An update on payer views pre- and post-Covid.

In January and February of 2020, CRA conducted a syndicated study — sponsored by pharmaceutical and biotech manufacturers — to quantify the price levels that U.S. payers believed to be fair for therapies used to treat rare diseases. We researched views on fair prices for a wide range of archetypes and actual therapies used to treat (1) a rare condition on a chronic basis or (2) a one-time cure, based on specific attributes of the disease (low vs. high prevalence, life-threatening vs. non-life-threatening condition, adult vs. pediatric population, etc.). Because fielding of the research for the 2020 study was just prior to the COVID-19 pandemic, this update provides insights into changes in the views of U.S. payers on the fairness of prices for therapies used to treat rare conditions.

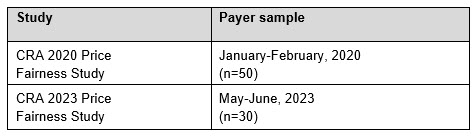

In 2023, we replicated essentially the same research methodology to identify changes to stakeholder views on the fairness of drug prices. The table below summarizes the timing and sample sizes for the research conducted in 2020 and 2023.

Table 1: Timing and sample sizes for 2020 and 2023 research.

Source: CRA Research and Analysis, 2023

The 2023 study was designed to provide insights into the perceptions of respondents about whether the prices of therapies are fair, and how perceptions of fairness depend on the characteristics of the therapy. We explored payer perceptions of fairness for both chronic therapies and curative therapies used to treat rare diseases. Our research methodology follows that of the pioneering paper on the topic of fairness of pricing practices — “Fairness as a Constraint of Profit Seeking: Entitlements in the Market” — by Nobel Prize winning economists Daniel Kahneman and Richard Thaler, and co-author Jack Knetsch, which provides a framework for identifying situations in which fairness can be an important consideration when setting prices.

Defining Baseline Archetype Therapies And Conditions

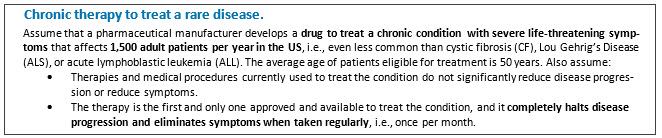

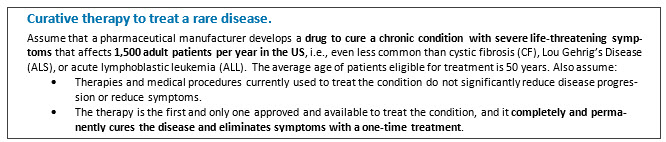

To develop treatment archetypes for review by payers, we defined two therapies together with specifics about the patient population and condition. Table 2 below explains the two baseline archetypes, one chronic therapy and one curative therapy, which were defined to provide sufficient detail for respondents to give feedback on what prices would be considered fair. Defining treatment archetypes allows us to evaluate a wide range of situations to identify the drivers of perceptions of fairness. It also avoids confounding interpretations of findings due to respondents’ pre-existing views about the prices or clinical performance of actual therapies. Separately from analysis of these treatment archetypes, our research obtained feedback from respondents on the perceived fairness of several existing therapies, which is discussed separately below.

Table 2: Baseline Archetype Therapies And Conditions

Source: CRA Research and Analysis, 2023

Source: CRA Research and Analysis, 2023

Perceptions Of Fairness: Baseline Archetypes

Without any additional context or information, respondents were asked whether specific price levels would be considered fair on a four-point scale (very unfair, somewhat unfair, somewhat fair, very fair). Based on their answers, additional questions were asked to determine the maximum price that would be considered fair.

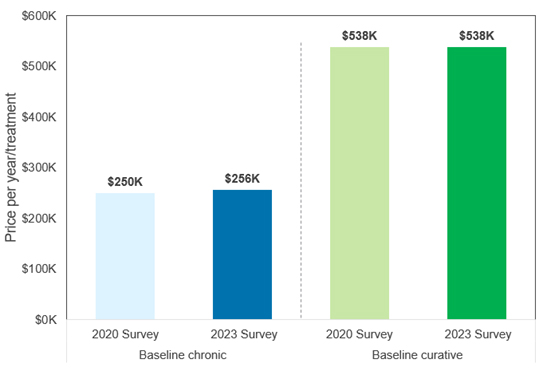

The prices identified by payer respondents as fair for the therapies and conditions defined in Table 2, without any additional or alternative information, are referred to as “baseline fair prices.” Figure 1 below shows the median baseline fair prices reported by payers for curative and chronic therapies in 2020 and 2023. In the recent study, the median prices viewed by payers as fair for baseline therapies for the chronic treatment of rare diseases was $256,000 per year. Similarly, for one-time curative therapies, the median price considered by payers to be fair was $538,000 per treatment. The median baseline fair prices reported by payers in 2023 are similar to those reported in 2020, specifically 2% higher for chronic therapies in 2023, and the same for curative therapies in 2023.

With the cumulative rate of inflation over this period being somewhat higher than the reported percent changes in perceived fair prices, these findings suggest that price sensitivity of the respondents may have increased somewhat over the period.

Figure 1: Payers’ Median Fair Prices For Baseline Archetypes, 2020 vs. 2023

Source: CRA Research and Analysis, 2023

Effect Of Context On Perceptions Of Fairness

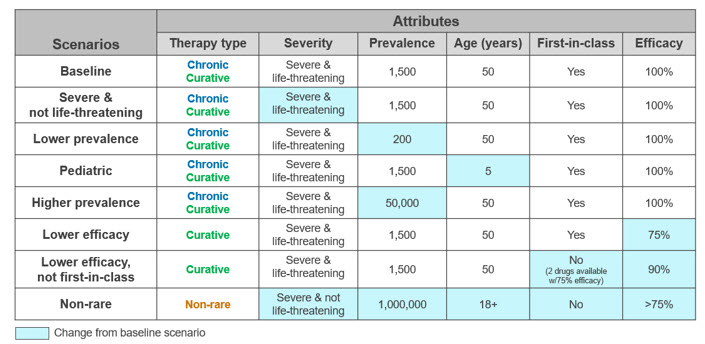

After identifying baseline fair prices for archetype therapies with limited additional context, alternative or additional information was provided to respondents to understand how their perceptions of fairness depend on varying the characteristics of the therapy, condition, patient population, and other aspects of the treatment and patient context. For example, we varied the context to understand how perceptions of fairness depend on the specific situation, including whether the condition is severe and life-threatening vs. severe but not life-threatening; differences in prevalence; differences in efficacy; timing of entry; or indications to treat adult vs. pediatric patients. A summary of these contextual scenarios is provided in Table 3.

Table 3: Alternative Scenarios For Evaluating Impact Of Fair Price Perceptions

Source: CRA Research and Analysis, 2023

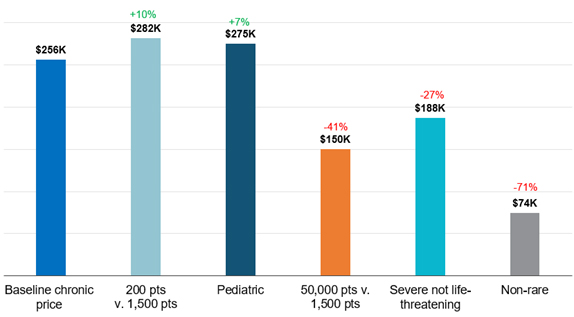

Chronic therapies for rare diseases: For chronic therapies used to treat rare diseases, several contextual elements were varied, and respondents were asked whether the prices they previously identified as being fair – their baseline fair prices – still would be considered fair, and whether higher prices would be considered fair. We also obtained the specific price that would be considered fair with the varied context, i.e., for those respondents who indicated that the baseline fair price would no longer be considered fair, or that a higher price would be considered fair.

Figure 2 shows the prices that are considered fair by payers for therapies used to treat rare chronic conditions under different circumstances. Within this figure we can observe that certain attributes, such as a smaller patient population or a pediatric indication, increase the median fair price while a larger population, a less severe disease, or a non-rare indication decrease the median fair price.

Figure 2: Payers’ Median Fair Prices For Alternative Scenarios: Chronic Therapies ($/year, n=30)

Source: CRA Research and Analysis, 2023

A comparison of the 2023 study findings with the 2020 study findings shows that the percent “premium” to baseline fair prices considered by payers to be fair is similar in 2023 for smaller populations and pediatric therapies and the percent “discount” to baseline fair prices is similar in 2023 for larger populations, and severe but not life-threatening conditions.

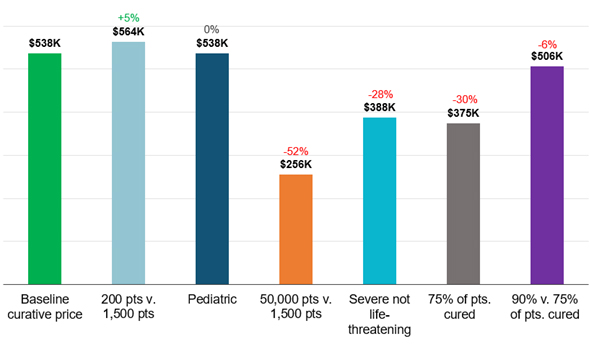

Curative therapies for rare diseases: For curative therapies used to treat rare diseases, a similar methodology was implemented to that of the chronic therapies.

Figure 3 shows the prices that are considered by payers to be fair for therapies used to treat rare curative conditions under different circumstances. Similar to the chronic therapy, we observed that a smaller patient population or a pediatric indication increased the median fair price, and a larger patient population or less severe disease decreased the median fair price. We also observed that decreasing the efficacy of the curative product had a negative impact on the median fair price.

Figure 3: Payers’ Median Fair Prices For Alternative Scenarios: Curative Therapies ($/treatment, n=50)

Source: CRA Research and Analysis, 2023

A comparison of the 2023 study findings with the 2020 study findings shows that the percent “premium” to baseline fair prices considered by payers to be fair is similar in 2023 for smaller populations and pediatric therapies and the percent “discount” to baseline fair prices is similar in 2023 for larger populations, and severe but not life-threatening conditions.

Effective Treatments And Cures Are Highly Valued By Payers

The findings from research of 30 U.S. payers involved in coverage decisions for rare diseases suggests that novel therapies that effectively treat or cure rare diseases are highly valued, as evidenced by their views on the prices that are considered to be fair for archetype and actual therapies.

- The median price per year considered to be fair for therapies used to treat rare chronic diseases was $256K per year. The median price considered to be fair for curative therapies was $538K per one-time treatment.

- The change in median fair prices for both chronic and curative therapies between 2020 and 2023 was small (within +/- 4%).

- Changes in the attributes associated with the disease (e.g., prevalence, patient population) and the therapy (e.g., efficacy) affects price levels that respondents consider to be fair.

The research reconfirms that context matters when it comes to perceptions of fairness. Generally, higher prices are considered to be fair for therapies that are more effective and approved to treat smaller patient populations or pediatric patient populations. In contrast, lower prices are considered to be fair for therapies that are used to treat severe conditions that are not life-threatening, and therapies approved to treat significantly larger patient populations. These findings were found to be similar when comparing the views of survey respondents in 2023 with previous findings reported in 2020.

About The Authors:

About The Authors:

Andrew Parece is vice president at Charles River Associates, and has more than 30 years of consulting experience. Parece specializes in competitive strategy, pricing, quantitative analysis, and market research in the pharmaceutical, biotech, and life sciences industries. He has managed competitive assessments and product launch strategy engagements for several high-profile products and franchises. Parece earned an MBA from Cornell University.

Matthew Majewski, vice president at Charles River Associates, has provided life science clients with analytically based solutions to their strategic issues for more than 20 years. Majewski has led a range of engagements from product-related topics such as positioning, pricing, contracting, and navigating disruptive market events to corporate challenges such as developing channel leadership, portfolio value creation, and organizational restructuring. He earned an MBA from Rutgers University.

Matthew Majewski, vice president at Charles River Associates, has provided life science clients with analytically based solutions to their strategic issues for more than 20 years. Majewski has led a range of engagements from product-related topics such as positioning, pricing, contracting, and navigating disruptive market events to corporate challenges such as developing channel leadership, portfolio value creation, and organizational restructuring. He earned an MBA from Rutgers University.

The authors would like to thank Ben Riley for his contributions to this article.